Does Your Money Deserve Our Help?

Whether you’re a first-time investor, reimagining your retirement, or anything in between, you need a team of financial professionals in your corner. It’s our mission to coordinate all aspects of your financial picture to get you guidance and insights.

One-size-fits-all financial blueprints? Not here.

Your goals are our goals. Regardless of your age or background, we believe people can live better lives with smart financial education and knowledge. We work closely with clients to match strategy to individual needs for every walk of life.

Who We Serve

Helping investors from every background

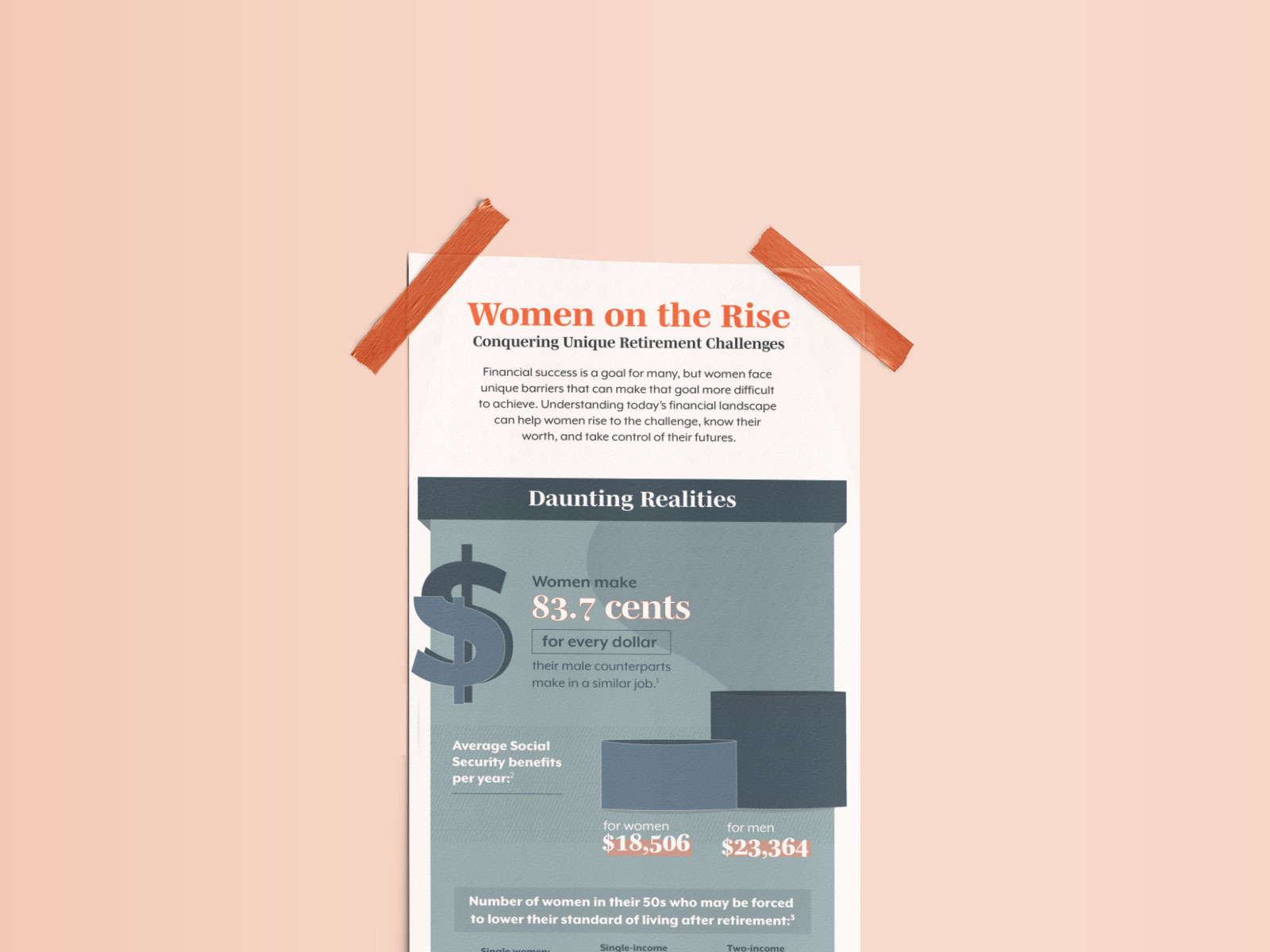

Women on the Rise

Our History

Years of experience have prepared us to guide you through your life transitions.

Our Values

Trust. Honesty. Integrity. We believe values matter, and we live by ours every day.

Our Resources

Want to learn more about retirement, social security, or estate strategies? We have a wealth of resources.

How can we help?

We understand that not everyone’s financial situation looks the same. That’s why we offer a complimentary introductory call to see how we can help you work toward your goals. A short call is all you need to get started.

Your Money. Our Know-How.

When was the last time you sat down and had an eye-opening conversation about your money, life, and goals? If it’s been a while, it may be time for some great advice from a professional source.

Whether you’re a first-time investor, wealth-builder, retirement-seeker, or beyond, we’re here for you. We’re proud of our team and the people we’ve helped, and we hope we can count you among them.

As Simple As 1, 2, 3

STEP

1

Let’s get to know each other

The more we know about you, your finances, and your goals, the better we can help.

STEP

2

Let’s make a plan

Our goal is to provide an amazing experience and a financial strategy that works with your lifestyle.

STEP

3

Let’s stick to the plan

Life is always changing, and so are you. We’ll be by your side through every twist and turn.

Get your financial journey started today.

Our first priority is helping you take care of yourself and your family. We want to learn more about your personal situation, identify your dreams and goals, and understand your tolerance for risk. Long-term relationships that encourage open and honest communication have been the cornerstone of my foundation of success.

Let’s talk.

We’d love to learn more about you and your financial goals. Our form is the best way to schedule a complimentary introductory call.